On March 29, 2025, New Zealand’s Consumer Data Right (CDR) became law, marking a milestone in the nation’s digital finance journey. By December 2025, all major banks are required to have live, production-ready Open Banking APIs — ushering in a new era of consumer empowerment and fintech innovation.

The momentum is real: On May 30, 2025, ANZ, ASB, BNZ, and Westpac jointly launched Payment Initiation API v2.3. This release introduces enduring payment consent and decoupled authentication. Such advancements and technical upgrades will fundamentally reshape how Kiwis interact with their money.

The Overlooked Frontier: Developer Experience

Much of the Open Banking conversation centres on policy frameworks, data standards, and commercial models. But there’s a crucial, often-overlooked audience: the developers. These are the people who transform standards into real-world products — navigating OAuth flows, parsing JSON payloads, testing endpoints, and debugging cryptic errors.

For every new API version or regulatory update, there’s a developer somewhere in Aotearoa wrestling with integration challenges. Their journey — onboarding, building, and launching — is the true test of Open Banking’s promise.

Why Developer Experience Drives ROI?

Open Banking APIs aren’t just technical interfaces — they’re products. And like any product, the user experience matters, especially for those integrating and consuming the APIs. A seamless developer experience isn’t just a “nice to have” — it’s a direct driver of ROI for banks and fintechs. Here’s why:

- Faster Onboarding: A huge chunk of developers time is wasted in learning how an API works, especially understanding different types of authentication schemes and writing code for them, frustrating both developers and business leaders. The quicker a developer can go from documentation to a working integration, the sooner products reach customers.

- Reduced Errors: Clear code samples, robust SDKs, and interactive docs mean fewer bugs and support tickets.

- Accelerated Innovation: When integration is painless, fintechs can focus on building value, not wrestling with plumbing.

In the highly competitive fintech space, time-to-market can define success — and developer experience (DX) is a key lever in speeding up that journey.

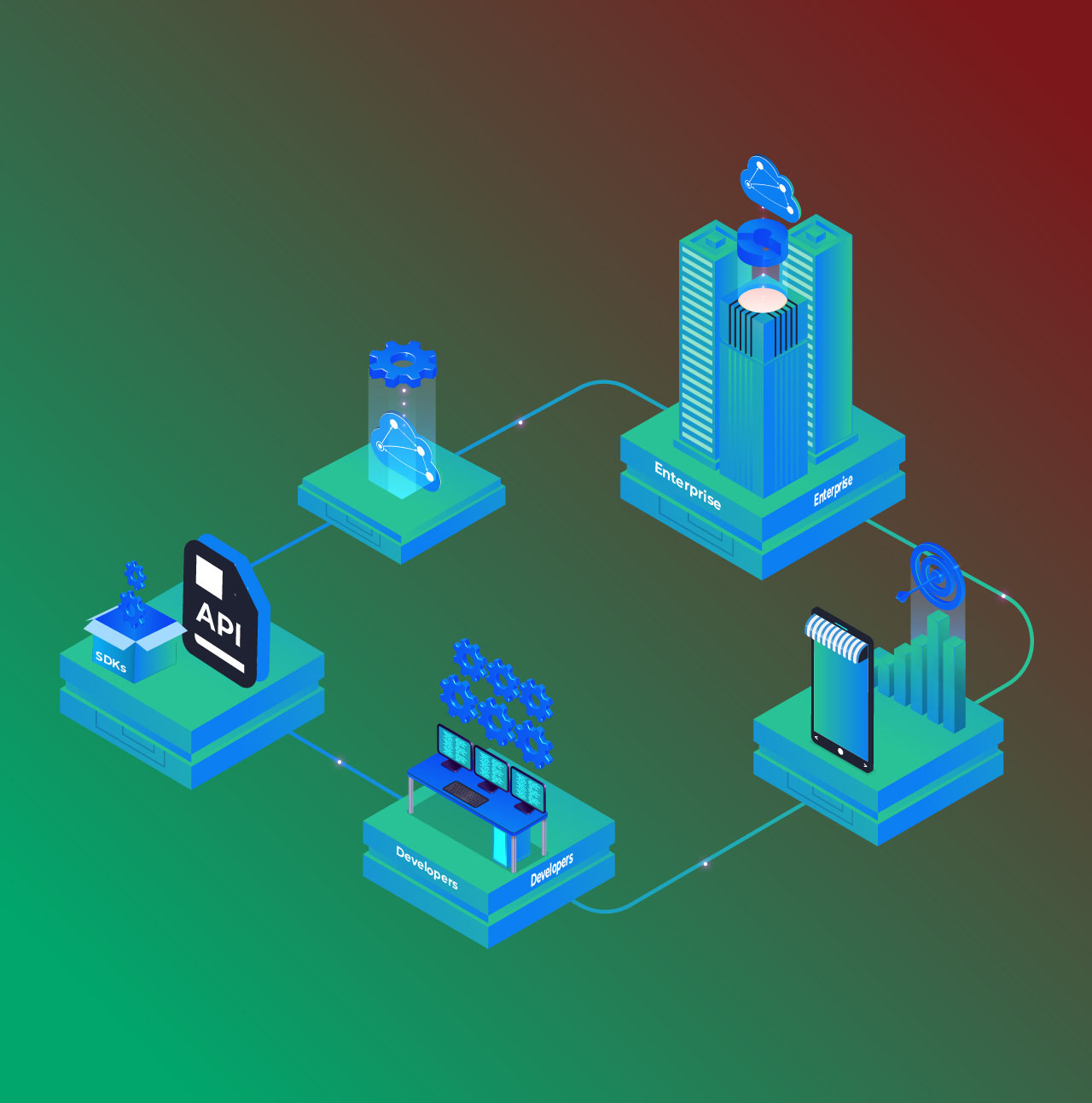

APIMatic: A Kiwi Solution to a Global Problem

This is where APIMatic steps in. Born in Auckland a decade ago, the DX platform has been trusted by the likes of PayPal, Shell, Verizon, WorldPay, Akoya and many more for maximizing API adoption and prompt developer onboarding.

How big of an impact a good developer experience can create? Look at this SDKs installations curve for a world renowned merchants payments processing API, powered by APIMatic.io:

SDKs installations for a Fortune 500 payments processing API, powered by APIMatic

A Personal, Failed Attempt with NZ Open Banking

I discovered the API Centre during COVID days, and immediately went on trying it to solve an internal use case. My need was to integrate incoming wire transfer notifications from our New Zealand bank account into a Slack channel, so my sales team could access this information without needing my direct involvement.

Excitingly, I asked a developer to build the integration using the “Account Information API”. However, we had to abandon the project after realizing that the API was not available in production at our bank. In addition, the significant hurdles my developer faced just to access the API Centre’s sandbox made me reflect on the challenges developers might encounter in integrating Open Banking APIs in future.

New Zealand’s Open Banking APIs — The Experience for Consumers of Today and the Future

My failed attempt did spark the idea of modernizing Open Banking API experience in Aotearoa, but I was not sure if the banks and FinTechs are ready for it. Now, with Open Banking going live in 2025, I think this is the right time to empower developers with an experience that could save a ton of their time and energy.

An Advanced API Portal

Today, when you land on the API centre Sandbox, you see a decade-old Swagger User Interface to try out the APIs. SwaggerUI was quite popular in 2010s, but today developers expect an advanced portal with API essentials such as SDKs & API Recipes in multiple programming languages. Moreover, with the recent proliferation of vibe coders, AI-native stack, and potential AI agents, features like MCP servers and API Copilots will likely to form a new norm. That’s exactly what APIMatic is building for the API consumers for today and the future.

As a demo, we generated an advanced portal to use the “Account Information API” from PaymentsNZ’s API Centre. This portal is mainly composed of 11 elements, divided into 2 categories:

- API essentials such as SDKs, API Recipes and Code Samples, and

- The AI additions including MCP servers and Integrate in Cursor.

Try this portal live here: https://api-center.demo.apimatic.io/

I- API Essentials for Prompt Onboarding and Integration

APIs are integrated by writing a lot of code. Smart companies realize the fact, and provide pre-built code to save over 80% of integration efforts for their consumers (watch this video for details). That pre-built code is deterministic in nature to provide identical experience to all the API consumers.

1. Easy Auth:

Probably the most time consuming task to make the first API call is setting up authentication. As an experiment, we placed the authentication button on top right corner of the portal. This button performs the OAuth dance in the background, and fetches the token for a user right at the portal. The fetched token is automatically added to all the API calls from there on, and remains available throughout the session.

2. SDKs for the fastest integration:

The portal is live with published SDKs in 7 languages: Java, C#, Python, Ruby, PhP, Typescript and Go. Providing SDKs in major programming languages allows developers to interact with APIs using the technology stacks they know best. This accelerates integration, ensures fewer errors, and reduces onboarding time — critical in finance, where accuracy and speed directly affect go-to-market timelines. Keen to know if you want to more languages to be added.

3. API Recipes for self-onboarding:

Like cooking recipes help chefs, API recipes get developers up and running with API use cases within no time. API recipes demonstrate how to combine multiple endpoints to accomplish a use case or a workflow — like initiating a payment and confirming authorization or fetching account balances and transaction histories in one flow (watch this demo video).

4. Idiomatic Code Samples

Idiomatic code samples — examples that follow the conventions and style of each programming language — help developers write code that feels natural and maintainable. In finance and open banking, where security, reliability, and clarity are paramount, such code samples reduce friction, streamline understanding, and lower the chance of bugs or misuse. They empower both newcomers and experts to quickly grasp the best practices for integrating with your API.

The code samples in the portal can be dynamically generated, and are fully compatible with the available SDKs in all 7 languages.

5. Interactive API Reference

An interactive API reference lets developers explore endpoints, try out requests, and see live responses, all within the documentation. This hands-on approach is invaluable in complex financial scenarios, allowing developers to validate their understanding and experiment safely before deploying changes to production. Interactive references significantly improve onboarding speed and minimize costly integration errors.

II- AI Additions for Next-Gen Developers,Vibe Coders and Agents

We recently hosted a students’ hackathon, and were amazed to notice the extensive use of AI coding assistants by young developers of today — and mainstream developers of tomorrow. Moreover, the AI Agents in future will not be “reading” API documentation like developers do — they’ll interact with APIs through standardized machine-readable protocols (like MCP, OpenAPI with LLM extensions etc). Therefore, it is important to add support for the AI-driven API consumption today, and keep improving as the technology evolves.

1- MCP Servers for AI Agents:

Model Context Protocol (MCP) servers streamline how AI agents and applications access financial data and services. They act as standardized intermediaries between AI tools and APIs — banking, trading, compliance, or analytics — ensuring secure, consistent, and efficient data exchange.

MCP enables interesting business cases for non-technical users via AI agents. For example, APIMatic recently won 2nd prize at an Open Banking conference in New York. The winning solution, “Talk to Your Bank Account”, helps users interact with their bank accounts using natural language. Instead of looking through complicated dashboards, users can simply ask questions like “How much did I spend last month on groceries?” and get instant answers. It’s like having a smart financial assistant in your pocket.

2- API Copilot for unlimited use cases:

Writing integration code for API use cases typically involve stitching multiple endpoints together, resolving authentication, creating HTTP request, dealing with serialization and what not. What if you get all this code in a language of your choice by just asking? The API Copilot understands your query, and uses AI + deterministically generated APIMatic code to give you the production-ready code for the desired use case.

3- AI Tools Integration to Meet Developers Where They Code:

Gartner projects that by 2028, 75% of enterprise software engineers will use AI coding assistants — up from under 10% in early 2023. That’s in addition to a vast number of vibe coders — materialzing their visions into apps within a matter of hours. Therefore, we are adding support to integrate APIs right within an IDE or an AI coding assistant. The real substance are the deterministically generated SDKs, which solve the hallucinations problem and massively bring down the cost of using an AI coding assistant.

The above portal supports integration in Cursor, while support for other tools is being added as I write these lines.

Conclusion: A Call for Modern API Experience

It’s time for New Zealand’s API ecosystem, particularly in Open Banking, to elevate the developer experience. Please try out this demo portal for Account Information API, and let us know what you think?

At APIMatic, we are ready to bridge the gap by providing Open Banking APIs in New Zealand (and worldwide) with all the tools and features that developers love. Let’s make API integration faster, smoother, and more efficient — just as it should be.

Let’s make API integration faster, smoother, and more efficient — just as it should be.

#OpenBanking #API #Fintech #APIMatic #DeveloperExperience #NZTech